Costs

Jackson County:

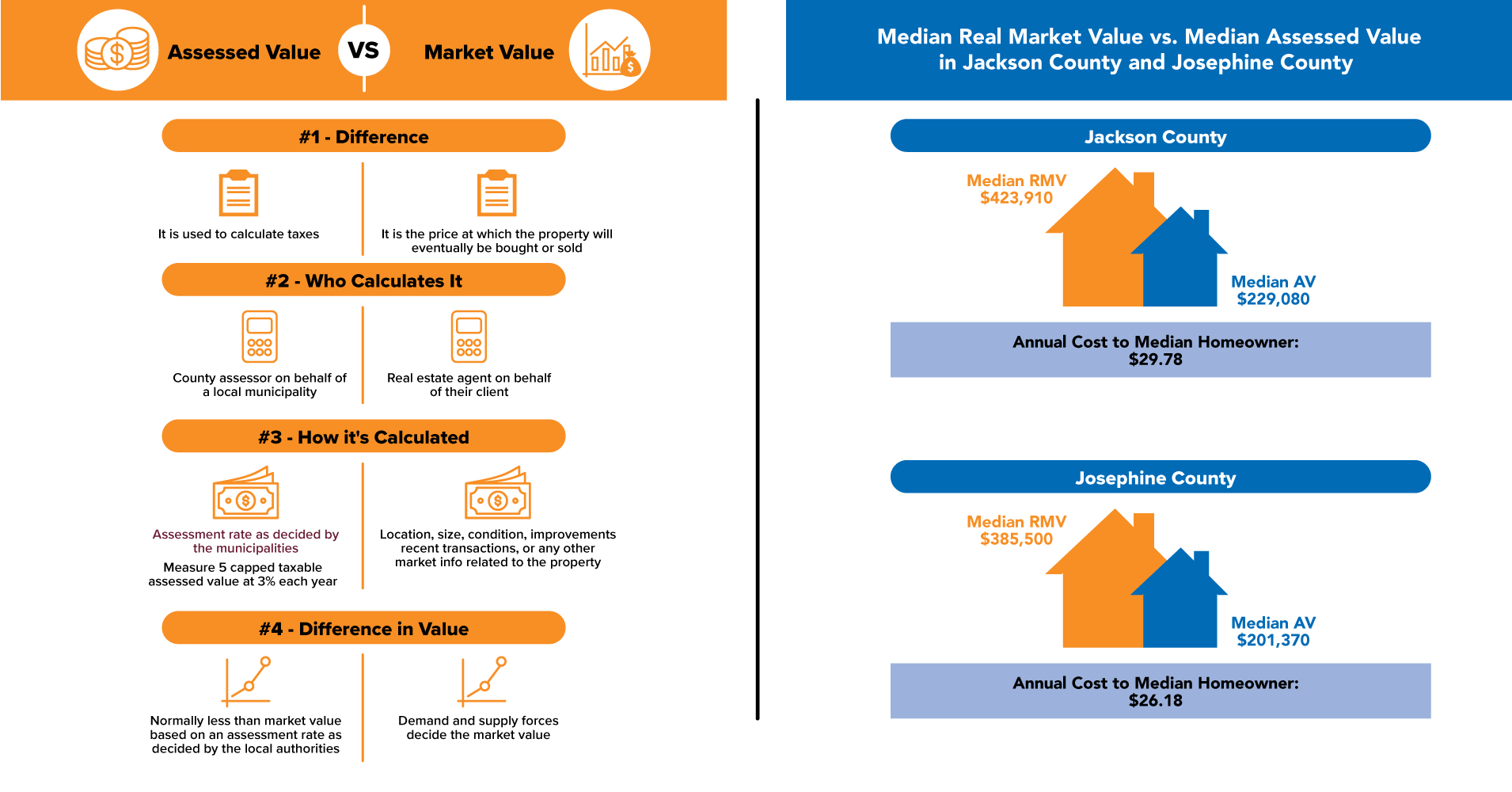

If passed, Measure 17-119 authorizes the college to sell bonds that would fund the projects outlined. The 2024 tax rate for property owners in Jackson County was $0.13 per $1,000 of assessed property value. The new bonds are estimated to maintain the 2024 tax rate of $0.13 per $1,000 of assessed value. If the bond measure passes, the average Jackson County homeowner would pay about $2.48 per month or $29.78 per year.